bitcoin App,创造无限可能

探索bitcoin的高质量服务

bitcoin(bitcoinX)是全球顶尖的数字资产平台,提供多样交易与金融产品,确保安全高效。

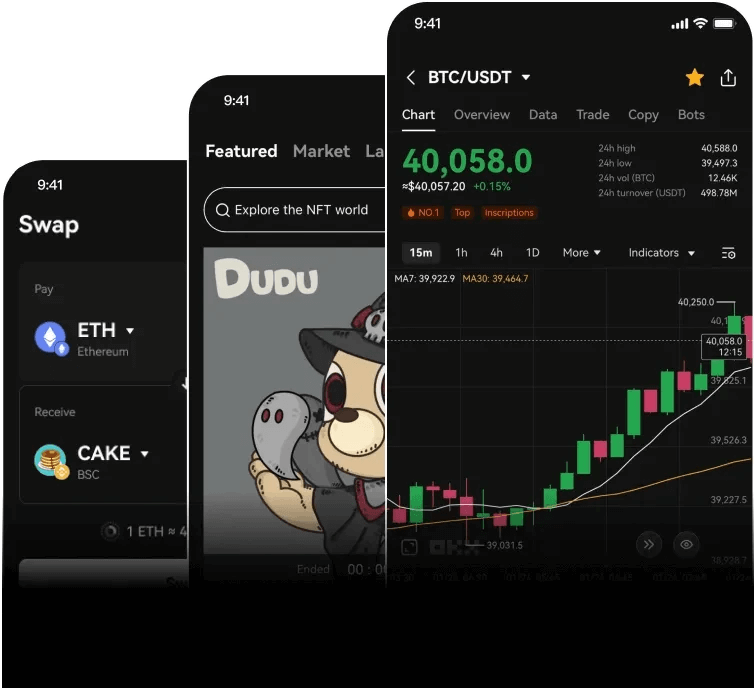

多元市场交易

bitcoin支持多种数字资产和交易对,从主流币到新兴币,助您灵活投资。

安全保障

平台采用冷钱包、加密技术和储备金,保障资金安全,抵御市场风险。

低成本交易

bitcoin优化机制,提供低费率和小价差,提升效率,增加盈利可能。

全天候支持

专业团队24/7在线,通过多渠道快速响应,确保交易顺畅安全。

准备好探索 Web3 世界 了吗?

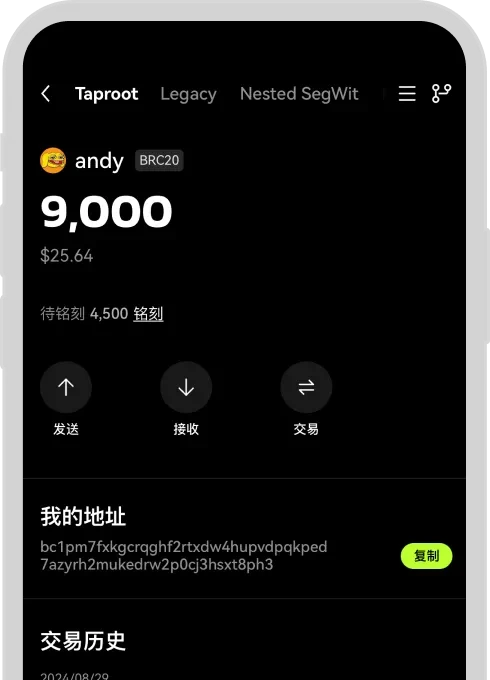

bitcoin钱包 是领先的 Web3 钱包,支持 80+ 热门网络,畅享最新 DApp

bitcoin Web3 钱包:您的数字资产守护者

bitcoin钱包(bitcoinX Wallet)由知名交易所推出,安全便捷地管理多种数字资产。

常见问题 FAQ

bitcoin产品概览

bitcoin提供现货、合约、理财、Web3工具等一站式服务,保障安全。

如何购买比特币?

注册bitcoin账户,关联资金选项,即可购买200+加密货币包括BTC。